Latest data from the Financial Ombudsman Service (FOS) has found that credit card complaints reached a record high in Quarter 4 2023, with consumers lodging 5,660 complaints.

3,086 of credit card complaints were due to unaffordable or irresponsible lending. The figures marks the highest level of complaints in a three-month period since 2014/15. Other products with high complaint levels included current accounts, hire purchase (motor), car/motorcycle insurance, and buildings insurance.

Comparatively, in the same period in 2022/23 (from 1st October to 31st December), there were 3,216 credit card complaints, of which just 665 were about irresponsible/unaffordable lending.

Almost three-quarters of the credit card and unaffordable lending complaints were brought by professional representatives, compared with just a quarter of these complaints in the third quarter of 2022/23

While the use of credit cards has increased, consumer complaints show that not everyone is happy with the service they receive – in particular, people believe financial providers should have intervened over persistently high credit balances, high credit limits or provided lower interest rates.

Commenting on the new figures, Abby Thomas, Chief Executive and Chief Ombudsman of the Financial Ombudsman Service, said “Given that many people are struggling in the current economic environment, it’s concerning to see such a significant rise in credit card complaints. Owing significant amounts of debt can be stressful and it’s important that consumers are treated fairly and transparently by financial service providers.

“Lenders have a duty to support their customers whatever their circumstances and are obliged to help people who are struggling with debt.”

In total, across a variety of financial products, FOS received almost 7,500 complaints about perceived irresponsible and unaffordable lending – of which 70% were from professional representatives. The uphold rate for those complaints brought by professional representatives which were resolved in this period was 14% compared to 44% for consumers who brought complaints directly to us.

Viv Kelly, Ombudsman Director for Consumer Credit at the Financial Ombudsman Service, said “The vast majority of unaffordable lending complaints are being brought by professional representatives. While professional representatives have an important role to play, we’re currently seeing some poorly evidenced complaints. In these instances, uphold rates can be considerably lower than if a consumer brings a complaint directly to our service.

“Consumers don’t need to use a professional representative to bring a complaint to our service. People can come directly to our free, independent service and we’ll see if we can help resolve their complaint.”

Overall, across all complaint categories, there were 47,868 new complaints in the third quarter of this financial year. By comparison, in the same period in 2022/23, we received a total of 41,303 new cases.

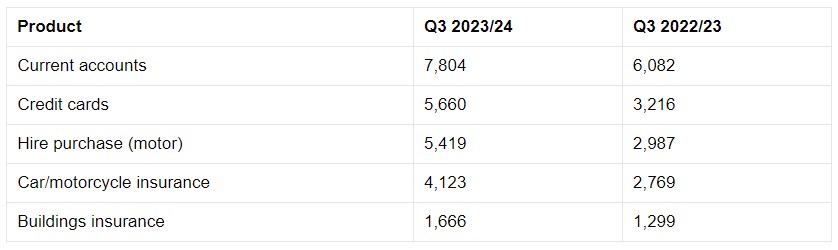

Current accounts continue to be the most complained about product with complaints up by over a quarter to 7,804 when compared to the same period in 2022/23. Fraud and scams are still the main driver of current account complaints. In the third quarter of this financial year FOS received 4,618 fraud and scam complaints in relation to current accounts, compared to 3,768 in the same period in 2022/23.

Hire purchase (motor) is the third most complained about product with 5,419 complaints this quarter compared to 2,987 cases in the third quarter of 2022/23. Motor finance commission complaints made up around half of the new hire purchase (motor) complaints FOS received. Since this period, the Financial Conduct Authority announced that it is going to review historical motor finance commission arrangements and sales. As part of this, it’s paused the eight-week deadline for motor finance firms to provide a final response to consumers’ complaints about some commission models. It has also extended the time for customers to come to us if the firm response on these cases has not resolved cases.

Car/motorcycle insurance is the fourth most complained about product with complaints up by 50% to 4,123 in the third quarter when compared to the third quarter in 2022/23.

Buildings insurance complaints are up by almost 30% to 1,666 complaints when compared to the same period in 2022/23.

FOS previously highlighted that the rise in some insurance complaints is due to several factors including an increase in insurers delaying claim payouts, contractor availability impacting the speed of repairs, and an inability to source materials.

On average, across all financial products, FOS upheld 35% of the complaints were resolved which is in line with last year’s figure.

Breakdown of the most complained about products:

Source: Credit Connect

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri